Prepare e-file IRS 1099 NEC, MISC, INT, DIV, R, A & K for 2024File 1099 Forms Online

File IRS 1099 A Form Online 2024-25

- File 1099 A Form now for the tax year 2024-25.

- Prepare anywhere and finish at any time with Form1099Online.

- File Form 1099 A online is the most cost-effective way.

- Stay away from filing compliances & start filing your 1099s now!

- No sign-up fee & pay for the 1099 Form when you submit.

Table of Contents

Who needs a 1099 A Tax Return?

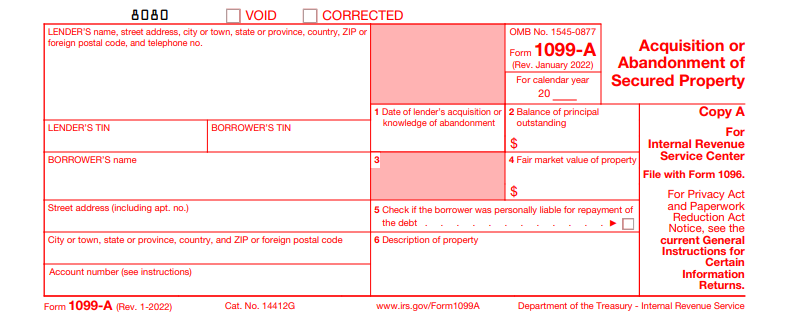

1099 A Form is officially known as “Acquisition or Abandonment of secured property”. Fill out this United States Internal Revenue Service Form if:

- A government unit or subsidiary agent lends money secured by the property.

- Multiple owners for a single loan and ear undivided interests such as in pools, fixed investment trusts, etc.

- You are a subsequent holder of a loan and reporting events occurring after transferring the loan to a new holder.

- More than one individual lends money secured by property & the other forecloses or acquires interests and the sale terminates.

How do I Fill Out IRS 1099 A Form?

As per the IRS 1099-A instructions, the lender must provide the below information to fill out a 1099 A:

- Lender’s business name & address, Federal Identification Number.

- Borrower’s name & address, FIN.

- Account number if in case the lender has multiple accounts for a borrower.

- Date of acquisition or abandonment of the secured property in box 1.

- Balance of outstanding debt at the time of acquisition or abandonment of the property in “box 2”.

- The fair market value of the property is in “box 4”.

- Check box 5 if the borrower is personally liable for repayment of the debt.

- Describe the property in “box 6”.

When to File IRS 1099 A?

The key due dates to file 1099 A tax return are given below:

| IRS 1099 A Form Copies | Due Date |

| Paper form Copy A to the IRS | February 28th, 2025 |

| E-file Copy A to the IRS | March 31st, 2025 |

| Borrower’s Copy B | January 31st, 2025 |

Steps to E-file 1099 A Form

Check out the steps to file 1099 A online:

Register for free– Create a free e-file account with an IRS-certified e-file provider. Or login to your e-file account with your credentials.

Choose the tax return– Select “IRS 1099 A” from the series of tax forms.

Fill in the form– Enter the necessary details like name, address, TIN, etc.

Double-check the details– Recheck the information you have provided.

Transmit the returns– Submit the tax returns to the IRS 7 to the payee within the deadline.

1099 A Vs 1099 C

Most of the payers don’t understand the difference between a 1099 A Tax Return & Form 1099 C. As per the IRS norms, a payer must use:

- 1099 A tax return for acquisition or abandonment of the secure property in a tax period.

- IRS 1099 C for cancellation of debt of $600 or more in connection with a foreclosure or abandonment of a secured property.

How secure is e-filing 1099 A with Form1099online.com?

E-filing 1099 A Tax Forms with Form1099online.com is 100% safe & secured. Because Form 1099 Online is certified by the IRS to participate in the e-filing program. Besides, the sensitive information you key is safely backed up in the cloud storage mechanism. The data is secured with bank-level security encrypted networks. Start for free & have multiple access at an affordable price.

Read More Related Information About 1099 A Online Form

Is Online 1099 A Form Required Acquisition or Abandonment of Secured Property?