Prepare e-file IRS 1099 NEC, MISC, INT, DIV, R, A & K for 2024File 1099 Forms Online

File IRS Form 1099 DIV 2024-25 Now

- Taxes are a pain, but filing your 1099 DIV forms doesn’t have to be. We make it easy, safe, and fast.

- Quickly and securely file your 1099 Forms with Form1099Online, an IRS-trusted e-file service.

- Form1099Online helps you comply with IRS requirements by offering a complete form solution for all your needs!

- Save time, money, and hassle with US-based customer service. We’ve got you covered.

Table of Contents

- 1099 DIV Form Tax Explained

- What is a 1099-DIV?

- Who needs a 1099-DIV?

- Tax Considerations for 1099-DIVs

- Why would I want one?

- Form 1099-DIV Instructions

- Who is mandated to file Form 1099-DIV?

- When is the IRS 1099 DIV Tax form filed?

- What Are The Requirements For Filing Form 1099-DIV?

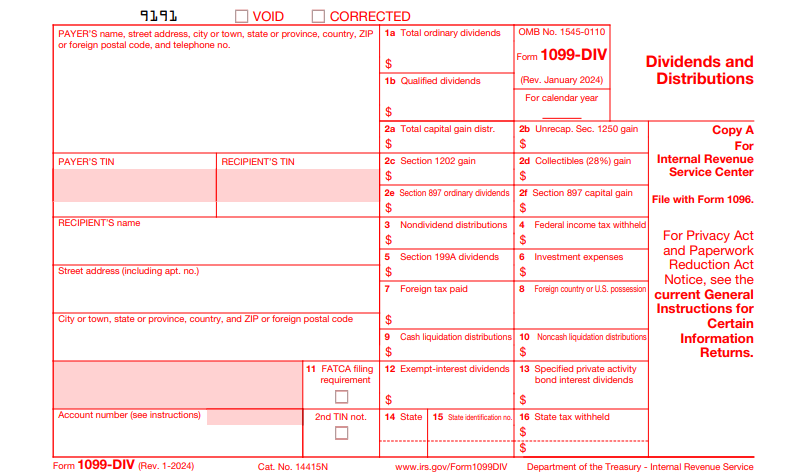

- How Do I Fill Out A Form 1099-DIV?

- What Are the Penalties for Failure to Submit Form 1099-DIV?

1099 DIV Form Tax Explained

The 1099-DIV tax form is a record that shows the investments and earnings paid to an individual in a tax period. It is filed by brokers, banks, and other financial institutions to show the IRS taxable income paid to the individual during business or trade.

What is a 1099-DIV Form?

The 1099-DIV tax form is a document that summarizes the dividends and other distributions you received from mutual funds during the year. The 1099 DIV tax form is used to report the dividend income you received during the year. Financial Institutions use this form, which must be filed with the IRS. Taxpayers who receive dividends must report the total amount of the dividends, including any taxable distributions and capital gains, on their tax return, even if they are not taxed at the preferential rates.

Form 1099-DIV can be issued in one of two ways:

- Paper form.

- Electronically via an IRS-authorized e-file provider like Form1099Online.

Who needs a 1099 DIV Form?

If you have paid any dividends or capital gains from investments during the year, such as stocks or mutual funds, you may need to file a 1099-DIV tax form.

You will also need to file if you pay an independent contractor or self-employed person who receives more than $600 in dividends or capital gains during the year on the course of business or trade.

Tax Considerations for 1099-DIVs

Income from dividends and capital gains is taxed differently than regular income, like wages. If this applies to you, be sure you know how much of your payment will be taxed at ordinary income rates versus long-term capital gains rates before filing your taxes this year!

Why would I want one?

1099-DIVs are required by law for all U.S. taxpayers who receive dividends, interest, capital gains, or other similar types of income from mutual funds,

stocks, and bonds located in the United States in amounts of $10 or more during any given year. 1099 DIV Tax Forms make it easy for anyone to report their dividend income for taxes. Simply download your 1099-DIV form from your email, fill out the income tax return form, and submit it to the IRS to meet your tax filing obligations.

Form 1099-DIV Instructions

Form 1099-DIV reports dividends and other distributions from stocks, mutual funds, and other investments.

You should receive a Form 1099-DIV from each investment that paid you $10 or more in dividends or other distributions during the year.

The form will show the total amount of dividends and other distributions you received from the investment during the year. It will also show any federal, state, or local taxes withheld from the payments.

You will need to report the information from the 1099 DIV Form on your tax return. The form will be used to calculate your taxable income for the year.

Who is mandated to file Form 1099-DIV?

- If you are a business owner or self-employed individual, you are generally required to file a 1099-DIV form for any dividends or capital gains you pay on investments you make. This includes earnings from stocks, mutual funds, and other investment vehicles.

- If you pay more than $10 in dividends or capital gains from your investments, you must file a 1099-DIV form with the IRS. This form must be filed by March 31st, following the tax year in which the earnings were received.

When is the IRS 1099 DIV Tax form filed?

This form is filed with the Internal Revenue Service on an annual basis. The tax year for this form is from January 1st through March 31st.

This form must be filed with the IRS electronically by March 31st of each year. A paper copy of the 1099 DIV Form must be submitted to the IRS by “February 28th” annually. Copy B of Form 1099 DIV must be forwarded to the taxpayer by “January 31st”.

What Are The Requirements For Filing Form 1099-DIV?

- To file Form 1099-DIV, you must be a financial institution or brokerage firm & pay dividends or other distributions during the tax year. Dividends can come from stocks, mutual funds, and other investments.

- You will need to provide the name and address of the financial institution or brokerage firm and your account number with them. You must also provide your Social Security number or taxpayer identification number.

How Do I Fill Out A Form 1099-DIV?

Here are some tips on how to fill out a 1099 DIV Form :

- Ensure you have all the necessary information before filling out the form. This includes your personal information and the type of investment made, i.e., the interest or dividends.

- Fill out the form completely and accurately. Include all required information, including your Social Security number and address.

- If you are unsure about anything on the form, ask a tax professional for help. They can answer any questions and help you complete the form correctly.

- Once you have completed the form, double-check it for accuracy. This will help ensure that your tax return is filed correctly and avoid penalties or fines.

What Are the Penalties for Failure to Submit Form 1099-DIV?

- You may be subject to heavy penalties if you don’t file Form 1099-DIV with the IRS. The most common penalties are failure to file tax returns within the deadline and failure to provide correct information.

- The IRS Form 1099 penalties generally start from $50 and may increase up to $550 depending on the day you file the tax return.

- In addition to these penalties, you may also be charged interest on unpaid taxes. The interest rate is determined by the IRS and is subject to change.

Read More Related Information About 1099 DIV Form

- IRS 1099 DIV Tax Form – 7 Things to Know For 2024

- How Do I Prepare to E-file Form 1099 DIV?

- Will the IRS catch a missing Form 1099 DIV?

- IRS 1099 Dividend Form guidelines

- 5 IRS 1099 DIV Form To-Do’s before the end of the Year

- 5 W s of IRS Form 1099 DIV

- 1099 Div Rules or Instructions for Business Owners in 2024