Prepare e-file IRS 1099 NEC, MISC, INT, DIV, R, A & K for 2024File 1099 Forms Online

File IRS 1099 R Form 2024

- Fast & securely file 1099 R online.

- Error-free IRS 1099 Form e-filing for 2024.

- Start for free and pay only when you submit 1099 R Forms online.

- File 1099 R Tax forms online & manage your time efficiently.

- Transmit multiple 1099 Tax Forms online at a cheaper cost.

Table of Contents

- What is an IRS 1099 R Tax Return?

- When am I required to File 1099 R?

- What are the Due Dates of the 1099 R Tax Return?

- Can you File the 1099 R Form Online?

- Does Filing 1099 R Online with Form1099online.com secure?

What is an IRS 1099 R Tax Return?

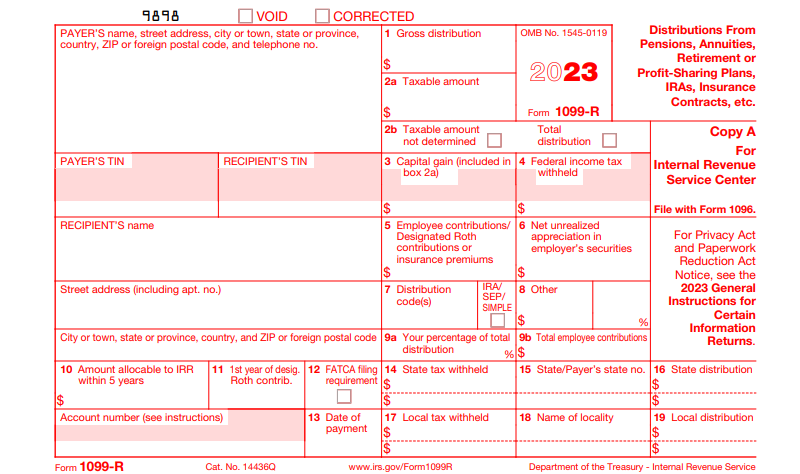

1099 R is one of the Internal Revenue Service Tax Forms. It is used to report distributions related to retirement benefits. This includes pensions, annuities, retirement plans, profit-sharing, IRAs, etc. Besides, IRS 1099 R is used to report distributions from private and public pension plans that are not included in the Civil Service System.

When am I required to File 1099 R?

Here are the IRS 1099 R Form requirements to know before filing:

- Distributions of $10 or more on a profit-sharing or retirement plan.

- Death benefits that are not a part of pensions, profit-sharing, or a retirement plan.

- Disability payments on a retirement plan.

- Payments are made to military retirees in a tax year.

- Income tax withholding and distributions from a section 475(b) plan maintained by a state or local government.

- Any reportable distributions from commercial annuities.

- Distributions on a charitable gift annuity.

- Payments of matured or redeemed annuity, endowment, and life insurance contracts.

What are the Due Dates of the 1099 R Tax Return?

As per the IRS norms, the 1099 deadlines to file a recipient copy and to the IRS are different. The deadlines to File both copies of IRS 1099 R are discussed below:

IRS 1099 R Form Copy A to the IRS – February 28th, 2025 for paper filing & March 31st, 2025 for e-filing.

1099 R recipient Copy B – January 31st, 2025 both for paper filing or e-filing.

Can you File the 1099 R Form Online?

Yes, you can e-file 1099 R tax returns online with an IRS-certified e-file provider. You can also create an e-file account for free by providing your email address & phone number. Follow the below Form 1099 R instructions to e-file the form in minutes:

- Login/sign up for the e-file account.

- Add/select the business information.

- Choose the tax return from the e-filing dashboard i.e., 1099 R.

- Fill in the form with accurate details.

- Double-check the information provided on the form.

- Transmit to the IRS and the recipient.

Read more: https://www.form1099online.com/blog/1099-r/efile-1099-r-form-instructions-for-2021-tax-year/

Does Filing 1099 R Online with Form1099online.com secure?

Yes, e-filing 1099 Tax Forms with Form1099online.com is 100% safe and secure. Because it undergoes numerous screening tests and is approved by the IRS to participate in e-filing. So, start your returns with a free e-file account and enjoy multiple filings with a single account. Get started now and experience an easy-to-use interface with 100% accurate transmissions.

Read More Related Information About 1099 R Form

Fillable IRS 1099-R Form For 2025 Tax Year

What is on a Federal 1099 R Tax Form?

Is it mandatory to file 1099 R Online? When is the deadline?

How to Completely Avoid the Hassles of File 1099 R Online?

Filing 1099 R Form for the 2025 tax year – Internal Revenue Service