Prepare e-file IRS 1099 NEC, MISC, INT, DIV, R, A & K for 2024-25 File 1099 Forms Online

File IRS 1099 S Form 2024-25

- File 1099 Tax S Form 2024 Online error-freely & accurately.

- Experience IRS 1099 S e-filing with reasonable prices.

- One step Sign up & start your success with Form1099Online.

Table of Contents

What is a 1099 S Form Used for?

1099 s tax form used to report the sale or exchange of real estate properties. Specifically, used to ensure whether the sellers are:

- Reporting their capital gains on the tax return

- Paying the appropriate taxes to the Internal Revenue Service.

Who must File?

Any organization that involves in the sale of real estate properties needs to file 1099 S Online. As per the IRS norms, IRS form 1099 s to report proceeds made from real estate transactions i.e., sales of:

- Improved or unimproved lands including air spaces

- Permanent structures of residential, industrial, or commercial buildings

- Condominium units, appurtenant fixtures

- Land, cooperative housing corporation stock, non-contingent interest in standing timber.

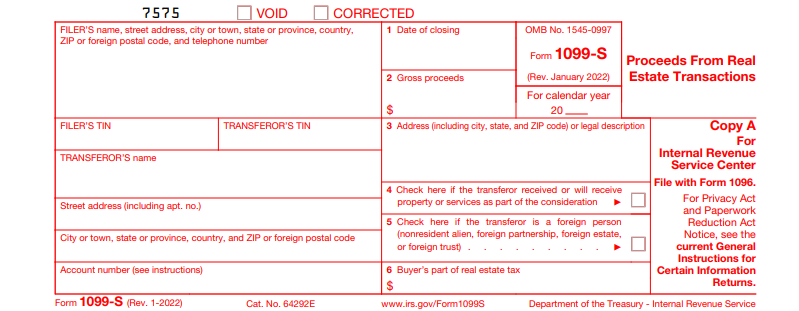

What information do you need to file 1099

Gather the below information to e file 1099 s IRS tax return

| Filer’s Info | Filer’s name, address, telephone number, Taxpayer Identification Number |

| Transferor’s Info | Transferor’s name, address, TIN, Account, or an Escrow number |

| Property Info | Date of closing, gross proceeds, address, & buyer’s part of real estate tax |

Boxes Information

| 1099 S IRS return Boxes | Information |

| Box 1 | Enter the date of closing |

| Box 2 | Enter the cash receives from the sale or exchange of real estate property |

| Box 3 | Enter the exact address of the property. This includes city, state, & Zipcode |

| Box 4 | Enter “X” if in case the transferor will receive or receive property as a part of the consideration |

| Box 5 | Enter “X” if the transferor recognizes as a “foreign person” |

| Box 6 | Enter the buyer’s part of real estate tax |

Due Dates for 2024-25 Tax Year

Following are 1099 s tax return deadline information:

Issue IRS 1099 S recipient copy – February 16th, 2025 (mail)

Furnish Copy A to the IRS – February 28th, 2024 (paper form) March 31 st, 2025 (e-filing)