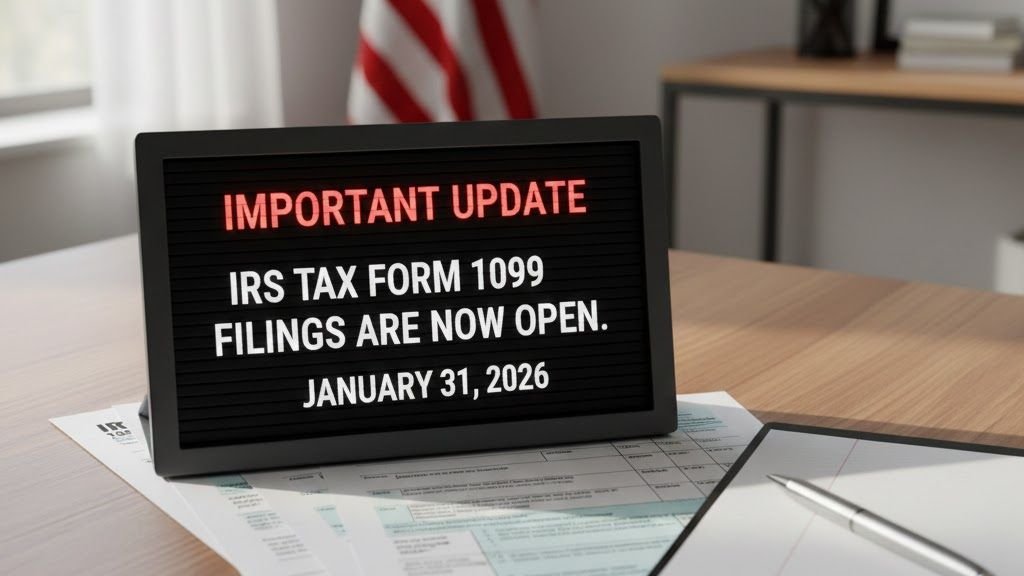

IRS Updates for the 2026 Tax Filing Season: Key Dates, Storm-Related Relief, and Reporting Changes

The IRS has released updates related to the 2026 federal tax filing season for 2025 returns. These updates include information about disaster-related deadline relief for specific areas in West Virginia, the start of the filing season, commonly applicable filing deadlines, and new information reporting requirements for digital asset transactions. The details below summarize publicly available […]